In 2025, insurance is no longer just about protecting against the unexpected—it’s about predicting and preventing risk before it happens. Thanks to the rise of big data analytics, insurers are making smarter, faster, and fairer decisions, reshaping how policies are written, priced, and managed.

From AI-powered underwriting to personalized risk scoring, big data is fueling a revolution in risk prediction. Here’s how the insurance industry is getting smarter, and what it means for customers and companies alike.

Introduction

At the heart of every insurance policy is risk assessment. Accurately predicting the likelihood of an event—like a car crash, health issue, or natural disaster—helps insurers:

- 💸 Minimize losses

- 📈 Set profitable yet competitive pricing

- 🤝 Offer better service to low-risk clients

With traditional methods falling short in a data-saturated world, big data analytics is now essential to underwriting accuracy and claims efficiency.

What Is Big Data in Insurance?

Big data in insurance refers to the enormous and complex datasets collected from:

- 📊 Structured sources (e.g., forms, financial records)

- 🌐 Unstructured sources (e.g., GPS data, social media, images, IoT devices)

These datasets are characterized by:

- Volume: Billions of data points generated daily

- Velocity: Data flows in real time from sensors, apps, and platforms

- Variety: Text, images, audio, and video formats combined with numerical data

Insurers use big data to understand patterns, predict events, and optimize decisions—often faster than any human could.

Traditional Risk Assessment vs Big Data-Driven Models

| Aspect | Traditional Model | Big Data-Driven Model |

|---|---|---|

| Data Scope | Historical averages | Real-time, granular data |

| Tools Used | Actuarial tables, spreadsheets | Machine learning, cloud platforms |

| Personalization Level | Low (group-based risk) | High (individual behavior and context) |

| Speed of Analysis | Days or weeks | Seconds or minutes |

| Claims Strategy | Reactive | Predictive and proactive |

In short, big data shifts the model from estimation to personalization.

Technologies Powering Big Data Risk Prediction

Several advanced technologies enable big data applications in insurance:

- 🧠 Artificial Intelligence (AI): Detects patterns, builds predictive models

- 🤖 Machine Learning (ML): Continuously improves predictions based on feedback

- ☁️ Cloud Computing: Stores and processes massive datasets efficiently

- 📡 IoT Devices: Feed real-time data from vehicles, homes, and wearables

- 🛰️ Geospatial Analytics: Uses satellite data for environmental risk modeling

These tools give insurers the agility to respond to new risks and customer behaviors instantly.

Types of Data Sources Used in Modern Risk Analysis

Insurers are now pulling data from sources such as:

- 🚗 Telematics devices in cars (speed, braking, driving habits)

- 🏠 Smart home sensors (temperature, water leaks, security events)

- ⌚ Wearables and health apps (activity, sleep, heart rate)

- 🌦️ Weather and satellite imagery (storm paths, fire zones)

- 💬 Social media activity (location tags, sentiment signals)

By combining these sources, insurers create multi-dimensional profiles that allow them to anticipate and price risks more precisely.

Real-Time Risk Scoring and Dynamic Pricing

Instead of flat rates, many insurers now offer:

- 📉 Usage-based pricing (e.g., pay-per-mile car insurance)

- 🧠 Behavior-based pricing (e.g., lower premiums for safer driving)

- 🔁 Real-time policy adjustments based on changing risk levels

This dynamic approach rewards safe behaviors, creates fairness, and allows faster coverage changes as life evolves.

Use Cases Across Insurance Lines

Big data is transforming all major insurance sectors:

| Sector | How Big Data Helps |

|---|---|

| Auto | Real-time driving data to assess accident risk |

| Health | Predictive analytics for chronic illness risk and treatment |

| Home | Smart sensors detect risk factors (fire, water damage) |

| Life | Health and lifestyle data for tailored underwriting |

| Commercial | Supply chain and operational analytics for business coverage |

Whether it’s predicting a hailstorm or spotting early signs of diabetes, insurers are leveraging data to make smarter decisions.

Fraud Detection and Prevention with Big Data

Insurance fraud costs the industry billions annually, but big data is making it harder for fraudsters to slip through the cracks. Insurers are using:

- 🧠 Pattern recognition algorithms to spot anomalies in claims

- 🌐 Network analysis to detect fraud rings and repeated actors

- 📸 Image analysis to verify authenticity of photos or documents

- 📈 Historical behavior data to flag unusual trends or exaggerations

By integrating AI-powered tools, companies can intervene in real-time or escalate suspicious cases to human investigators, reducing fraud and saving money.

Customer Segmentation and Personalization

Big data enables deep customer insights, allowing insurers to segment and serve customers more effectively:

- 🎯 Behavioral segmentation: Grouping users by lifestyle, purchase patterns, or engagement

- 🧬 Risk profiling: Creating dynamic models that update based on behavior or life events

- 📢 Targeted marketing: Delivering relevant offers based on location, need, or risk level

- 🔁 Retention strategies: Predicting churn and offering incentives to stay

The result? Customers receive policies tailored to their real needs, while insurers improve conversion and loyalty.

Benefits for Insurers and Policyholders

The adoption of big data in insurance is a win-win:

For Insurers:

- 🔍 More accurate pricing and underwriting

- ⏱️ Faster, more efficient claims processing

- 💼 Stronger fraud prevention and detection

- 📊 Better insights for product innovation

For Policyholders:

- 💰 Fairer premiums based on actual behavior

- ⚡ Quicker policy issuance and claims settlement

- 📱 More control over coverage via mobile apps

- 📉 Discounts for safe or healthy behavior

Big data creates transparency and accountability, aligning insurer goals with consumer interests.

Challenges of Using Big Data in Risk Prediction

Despite its advantages, integrating big data presents several challenges:

- 🧱 Legacy system compatibility: Older infrastructure may not support real-time data ingestion

- ⚖️ Bias in algorithms: If training data is flawed, models may produce unfair outcomes

- 🔐 Data privacy concerns: Consumers may hesitate to share sensitive health or behavioral info

- 🧑💻 Skills gap: Insurers need data scientists and engineers to build and maintain these systems

These challenges require strategic investments in technology, ethics, and talent to fully realize big data’s potential.

Regulatory Considerations and Data Ethics

As data volumes grow, so does regulatory oversight. Insurers must now:

- 📜 Comply with data privacy laws like GDPR, HIPAA, and CCPA

- 🔍 Ensure algorithmic transparency in pricing and claims decisions

- ✍️ Obtain explicit consent before collecting or analyzing personal data

- 🧑⚖️ Demonstrate fair and non-discriminatory practices

Data ethics is no longer optional—it’s a foundational requirement for trust and long-term success in the insurance industry.

Top InsurTechs Leveraging Big Data for Smarter Insurance

These forward-thinking companies are leading the charge:

- 🛰️ Zesty.ai: Uses satellite data and AI to assess wildfire and property risk

- 📊 Carpe Data: Analyzes alternative data sources (social, online activity) for risk assessment

- 🔍 Shift Technology: Focuses on fraud detection with advanced pattern recognition

- 🧠 Lemonade: Offers real-time risk scoring and instant claims using AI and behavioral data

- 📷 Tractable: Applies computer vision to auto and property damage analysis

Their success highlights how big data is reshaping insurance from the ground up.

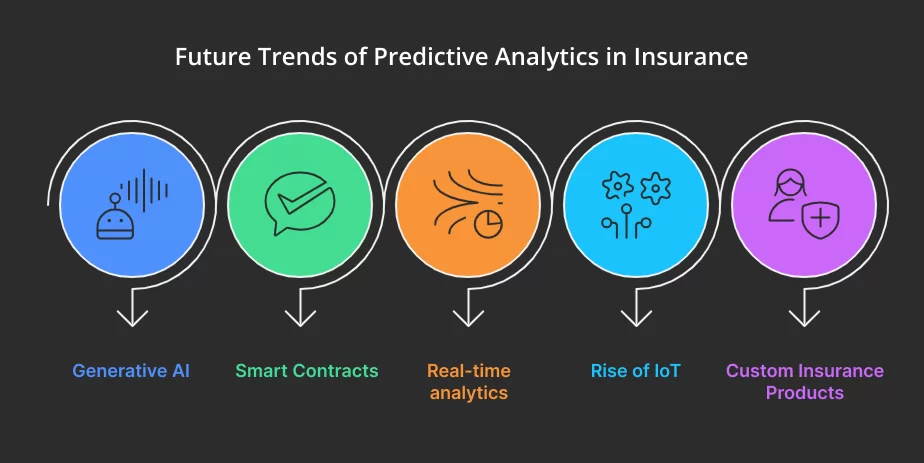

Future Outlook: Predictive, Preventive Insurance Models

Looking ahead, big data is pushing insurance toward a preventive, advisory model:

- ⚠️ Early warning systems detect high-risk behavior or environmental hazards

- 🧑💻 AI advisors guide customers toward safer choices or healthier lifestyles

- 🔄 Dynamic risk forecasting lets insurers adjust coverage and pricing in real time

- 🧠 Continuous risk learning makes each claim smarter than the last

Insurance will no longer just cover loss—it will actively work to prevent it.

Conclusion

In 2025, big data isn’t just making insurance smarter—it’s making it more personal, proactive, and equitable. By tapping into massive datasets and advanced analytics, insurers are creating systems that understand risk more clearly and respond more intelligently than ever before.

As this technology continues to evolve, expect insurance to shift from a reactive safety net to a predictive partner—one that helps you avoid risk before it happens, while delivering faster claims and fairer prices when it does.