From phantom insurance claims to sophisticated payment scams, fraud costs the global economy trillions of dollars annually. As criminals become more sophisticated, traditional rule-based systems are no longer enough to protect businesses and consumers. Enter Artificial Intelligence (AI), a powerful ally capable of analyzing billions of data points in real-time to uncover and neutralize threats.

This article explores real-world case studies, showcasing how leading companies across banking, insurance, and e-commerce are successfully deploying AI to win the war against fraud.

Why Traditional Fraud Detection Falls Short

For decades, fraud detection relied on static, rule-based systems. These systems flag transactions based on simple, predefined triggers, such as an unusually large withdrawal or a purchase from a high-risk country. However, this approach has significant limitations:

- High False Positives: Legitimate customer transactions are often incorrectly flagged, leading to frustration and lost business.

- Slow Adaptation: Rules must be manually updated, leaving systems vulnerable to new and evolving fraud tactics.

- Inability to See Complex Patterns: Rule-based systems cannot identify subtle, coordinated attacks that span multiple accounts or platforms.

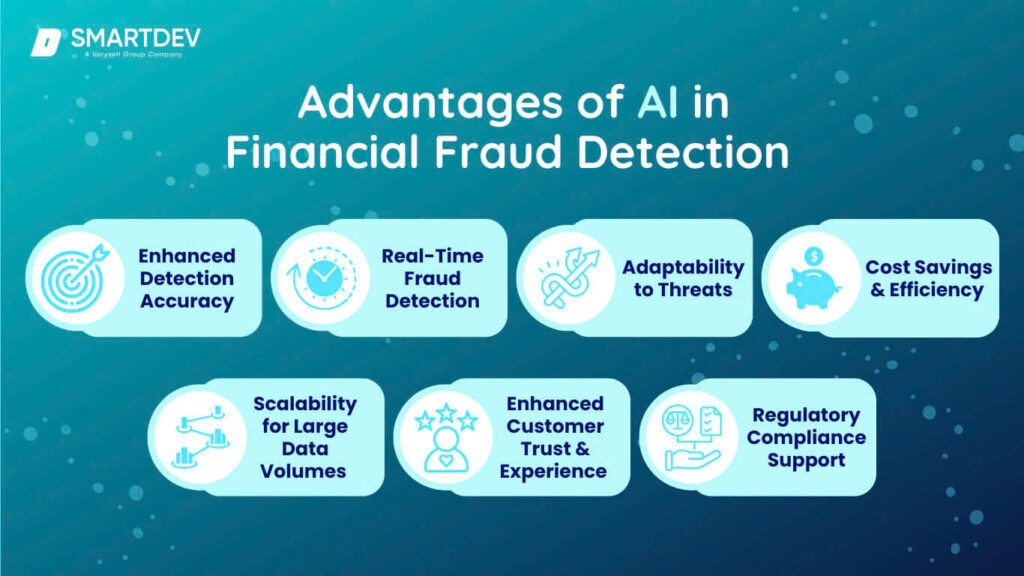

AI overcomes these challenges by using machine learning (ML) models that learn what “normal” behavior looks like and adapt in real-time to identify suspicious anomalies.

Case Study 1: Banking & Financial Services

The financial sector, a primary target for fraudsters, has been a pioneer in adopting AI for protection.

Mastercard: Slashing False Declines with AI

The Challenge: One of the biggest problems in payment processing isn’t just fraud—it’s “false declines,” where a legitimate transaction is wrongly rejected. This damages customer trust and results in significant revenue loss for merchants.

The AI Solution: Mastercard developed Decision Intelligence, an AI platform that analyzes vast amounts of data for each transaction in real-time. Instead of just applying fixed rules, it assesses the context by looking at:

- Cardholder spending habits

- Time of day and location

- Merchant category

- Device information

The Impact: By understanding the cardholder’s “normal” behavior, the AI can approve legitimate but unusual purchases (like a one-off large buy for a holiday) while accurately identifying truly suspicious activity. This approach has drastically reduced the number of false declines, improving the experience for customers and merchants alike, all while keeping security tight.

PayPal: Protecting Billions in E-commerce

The Challenge: As a global leader in online payments, PayPal processes millions of transactions daily, making it a massive target for card-not-present (CNP) fraud and account takeovers.

The AI Solution: PayPal was an early adopter of AI, building sophisticated machine learning models that have been refined for over a decade. These algorithms analyze complex variables for every transaction, including:

- IP address and geolocation

- Transaction velocity and history

- Device fingerprinting

The system learns from every transaction, constantly updating its understanding of fraudulent tactics.

The Impact: Thanks to its AI-driven approach, PayPal maintains one of the lowest fraud rates in the industry. The company has reported blocking over $4 billion in fraudulent transactions annually while keeping its false positive rate below 1%, ensuring that legitimate payments are processed seamlessly.

Case Study 2: Insurance

The insurance industry loses tens of billions of dollars each year to fraudulent claims. AI is now being used to analyze claims with a level of detail that was previously impossible.

Allstate & Progressive: Uncovering Fraudulent Claims

The Challenge: Insurance fraud can range from exaggerated injury claims (soft fraud) to deliberately staged accidents (hard fraud). Manually investigating every suspicious claim is time-consuming and expensive.

The AI Solution: Major insurers like Allstate and Progressive have deployed machine learning and natural language processing (NLP) to automate claims analysis. Their AI systems can:

- Scan and analyze thousands of claims documents, medical records, and incident reports for inconsistencies.

- Flag anomalies, such as multiple claims from the same address or identical wording across different incident reports.

- Use predictive models to assign a “risk score” to each claim, allowing human investigators to prioritize the most suspicious cases.

The Impact: Progressive reported that its AI models improved fraud detection accuracy by 35%. Allstate’s real-time scoring system has cut investigation time by 50% and increased detection rates by 40%, saving the company over $160 million annually and streamlining the process for legitimate policyholders.

Aviva & Tractable: Fighting Fraud with Computer Vision

The Challenge: A common type of auto insurance fraud involves submitting manipulated or recycled photos of vehicle damage to support a false claim.

The AI Solution: Insurers like Aviva have partnered with AI firms such as Tractable, which specializes in computer vision. When a claimant uploads photos of vehicle damage, the AI:

- Analyzes the images for signs of digital tampering or editing.

- Cross-references the photos against a massive database to check if they have been used in previous claims.

- Assesses the damage to ensure it is consistent with the details of the accident report.

The Impact: This technology has reduced fraudulent claims by nearly 30% and has the added benefit of accelerating the approval of legitimate claims, often cutting resolution time by weeks.

Case Study 3: E-commerce

E-commerce businesses must balance providing a smooth customer experience with protecting against fraudulent purchases, fake accounts, and promotion abuse.

eBay: Defending a Global Marketplace

The Challenge: With millions of buyers and sellers, eBay must combat a wide array of fraudulent activities, including fake listings, account takeovers, and organized fraud rings creating fake reviews.

The AI Solution: eBay uses a multi-layered AI security system that analyzes user behavior, transaction patterns, and listing details. Its deep learning algorithms can:

- Identify subtle patterns that indicate a fraud ring is at work.

- Verify user identities and flag suspicious login attempts.

- Detect and remove fraudulent listings before they can harm buyers.

The Impact: eBay’s AI can detect the vast majority of fraudulent accounts before they even make their first transaction, protecting the integrity of the marketplace and maintaining trust among its millions of users.

Conclusion: A Smarter, More Secure Future

These case studies represent just a fraction of how AI is being deployed in the global fight against fraud. The key advantage of AI is its ability to learn and adapt, staying one step ahead of criminals in a way that static systems never could. By leveraging machine learning, natural language processing, and computer vision, companies are not only protecting their bottom line but also creating a safer and more seamless experience for their legitimate customers. As these technologies continue to evolve, AI will become an even more indispensable tool in building a secure digital economy.